Not this kind of T47 – French Battleship Photograph by Rama Wikimedia Commons

Everyone keeps talking about the T-47 when I sell my house. This is why:

What is a T-47?

The T-47 is a Residential Real Property Affidavit. It’s a notarized document that tells the buyer of your home what you know about the home’s boundaries.

Who needs the T-47?

The buyer needs this affidavit, and it is used by their lender and title company to figure out whether they are going to accept the survey the seller has provided, or if they require a new one.

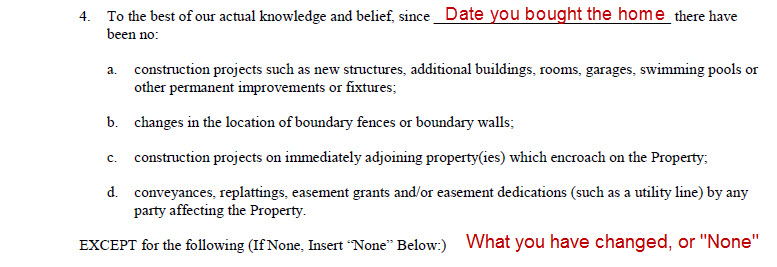

Typically, a seller might want to say, “I’ve changed no fences and added no extensions to my home, please use the same survey that I got when I bought the home for title insurance purposes”. The T-47 is a sworn statement to that effect.

Or a seller might use the T-47 to swear, “I added a slab for a new shed in my yard since the last survey was performed. Please consider re-using the old survey again.” (in this case, the lender and title company probably would require a new survey, as they can’t tell without physically going to your house that you didn’t build it entirely in the allowable portion of your lot)

Sometimes there are grey areas, and it’s up to the discretion of the lender and title company, for example if you use the T-47 to swear, “I replaced my fence on the existing fence line since I bought the home.” or, “I moved the fence two feet towards my house since the existing survey was performed”.

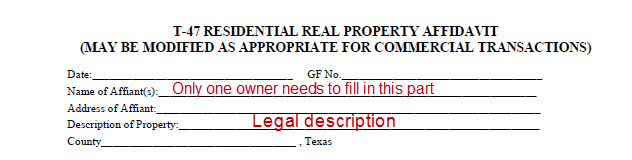

How do I complete a T-47?

First, get a copy of your survey from when you bought the home. If you don’t have one, you might be able to get in touch with the title company at which you closed escrow on the purchase of your home and ask them for a copy. If it was decades ago, there may be little point trying to find a survey.

Ask your agent for the Legal Description

If you can’t find a survey, don’t bother filling in the T-47. A new survey will be required for title insurance purposes.

Some of the fields are easy – date, name, address. The Affiant in question is you the seller. If you are married or own the home in common with someone, only one of you needs to fill their name in and sign in front of a notary. You can leave GF number blank – this is a file number for use by the title company at which you sell your home.

The description is a legal description. You can look that up in the tax records or ask your Realtor to tell you it. In a regular subdivided home, it will be something with a format like “Lot 5 Block C University Hills Subdivision”. It should also be recorded on the survey that you have in front of you.

Section 4 – this allows you to write the date that you bought the home (or the date of the survey if the survey was more recent). Then you have to put a list of things that you have changed that might affect the accuracy of the existing survey. If nothing has changed to impact the boundaries, make sure to write in “None” at the end of Section 4. I’ll say it again, don’t forget to right “None” if nothing has changed.

Don’t forget to write “None” if nothing has changed

Then you should take along your T-47 to a notary to sign it and have the affidavit notarized. You can find notaries in banks, in offices, at title companies, and law offices for example.

When should I fill in the T-47?

The affidavit is part of the Texas promulgated home purchase contract, and has conditions attached to it. My advice is to complete the form before you list your home for sale – before you even receive a contract. That way you avoid missing a contractual deadline to provide the survey and the related affidavit.

Why should I fill in a T-47?

In short – to possibly save someone $500.

The person who buys your home will most often require title insurance – a commitment that they are buying what they think they’re buying, and that you have the right to sell it, and that it can be represented by boundaries drawn on a piece of paper called a survey.

A survey on the average home in Austin might costs from between $400 and $550. By providing a T-47, you might be saving someone from buying a new survey. Depending on how you negotiate, either you or the buyer may need to buy a new survey, and someone definitely will if you don’t fill in the T-47.

Where can I get a T-47?

You can get one from your title company, the Texas Department of Insurance (though this inexplicably has no space at the end of Section 4 to fill in “None”). Or your agent can provide you with the Texas Association of Realtors version of the form, like this TAR 1907 Residential Real Property Affidavit sample.

What Do You Do?

We sell houses. Really well. We are a team of real estate agents who provide leading marketing and expert advice when it comes to selling homes in and around Austin, Texas. Get in touch with one of our REALTOR team if you have a question – 512 215 4785.

14 Comments

Flora Gerold · February 17, 2015 at 10:25 am

Do we need a new survey if we added a hot tub in our yard since we bought our house? It sits on the slab that was originally poured for a small outbuilding that we tore down.

An Austin Realtor · February 17, 2015 at 10:28 am

If the original survey shows the slab in place, then I would expect you haven’t changed any boundaries and should be able to use the existing survey. If in doubt, disclose everything on the form – it’s better not to assume any liability by omitting any information in the home selling process.

Alex Westlake · February 17, 2015 at 5:23 pm

This is just another example of a spurious fee charged to a home seller when they come to sell their home. Between the realtor cartel and the title companies and the lenders with all the junk fees they add to the mix, it’s a wonder the seller can realize any equity in their home sale. Now the survey companies are in on the act, charging $500 to come and see if you’ve moved your fence three inches so that the lender can tell the title company that it’s all okay? Ridiculous.d

An Austin Realtor · February 18, 2015 at 3:22 am

There are certainly lots of parties involved in a real estate transaction and they all have their fees. Transaction costs for real estate are high. Much higher than in other parts of the world. The T47 is the form that can save you $500 or the cost of a survey – it’s the good news form.

If you’re buying a home for cash, then the buyer can elect not to have the seller pay for title insurance, so you can save that fee as a seller, though most buyers expect it. If they had to pay for it (as is sometimes the case when a buyer is purchasing a new home), then the buyers might ask more questions about whether it is necessary or if they might be okay with just a title search.

If you choose to move your fence, then you’re potentially changing the boundary of the thing you’re selling – perhaps annexing your neighbor’s yard. So unless you have your original surveyor come out and verify that you haven’t moved it outside of your boundary then the person buying the home needs some reassurance that you haven’t.

Title insurance is part of borrowing money secured against a house, and Realtor fees are part of the market costs, and yes I think you’re right that Realtors do for the most part control the market.

Katherine · March 26, 2015 at 7:29 pm

I need help with this! Thanks. BTW, if anyone needs to fill out a t 47 form, I found a blank form here http://bit.ly/1EZxoL6

An Austin Realtor · March 31, 2015 at 2:58 pm

thanks for the useful resource Katherine!

Ana · March 24, 2017 at 3:11 pm

If the T47 is only signed by sellers but not notarized is it valid?

An Austin Realtor · March 27, 2017 at 6:38 am

I see lots of agents / title companies doing this – saying that the seller will sign now, and then have it notarized at closing. This is just lazy in my opinion. The document isn’t valid until it is notarized.

Ana · March 27, 2017 at 11:38 am

Thank you!

Dave Taylor · September 19, 2017 at 2:56 pm

In my opinion the date in paragraph 4 is the date on the survey being provided, not the date the home was purchased. The T-47 is a reflection of the Survey, not the date the property changed hands. Again, in my opinion, when a buyer accepts an existing survey the are also accepting responsibility to prove a failure to disclose (if an issue is found in the future) if they pass the survey onto the next buyer. That’s why it is usually not always a good idea to accept an existing survey. Especially if some time has passed.

An Austin Realtor · October 3, 2017 at 10:41 pm

Good point Dave – I think there’s some risk as you say. The lender is generally the most risk averse party in a transaction IMHO, and so if they allow it, most people are going to be okay. One important point that I think we agree on is that buyers deserve to know the risks they’re taking, the implications and the costs of mitigating them.

Sachin · December 25, 2017 at 9:28 pm

Dave,

Could you please elaborate on the risks that you are talking about. Survey reveals everything that is visible to naked eye like foundation, slab, fence, boundaries, etc. what’s hidden behind the walls is not included in survey. If no modifications were done to the property as disclosed, then where is the risk?

G Hennessey · December 14, 2017 at 11:12 am

Where is latest T47 please? link broken

An Austin Realtor · December 14, 2017 at 11:41 am

I just double checked both links to T-47s and they are both still accurate.