We are living through uncertain times with the current pandemic, and we get asked over and over, what happens to Austin house prices during a recession?

Two recent recessions with good data

The level of uncertainty makes it hard to predict what’s coming in the next 6 months, so we decided to take a look at recent public real estate data available from Texas A&M’s Real Estate Center, and recession data from the National Bureau of Economic Research.

The last two recessions have the best data for our purposes. They’re certainly not an exhaustive list, but they do show some interesting results.

The first is the early 2000s recession of 8 months starting in March 2001.

The second is the subprime crisis in lasting 18 months from December 2007.

Austin House Prices Through Previous Recessions

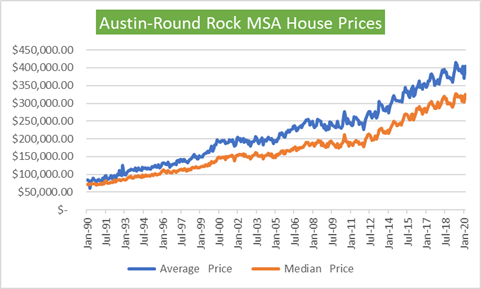

We haven’t highlighted these time periods on the plot of average and median house prices below.

If you’re looking for two big drops in actual sales prices in 2001 or 2008, you’d be hard pushed to detect them over and above the annual cycle.

Austin House Prices Don’t Follow National Prices

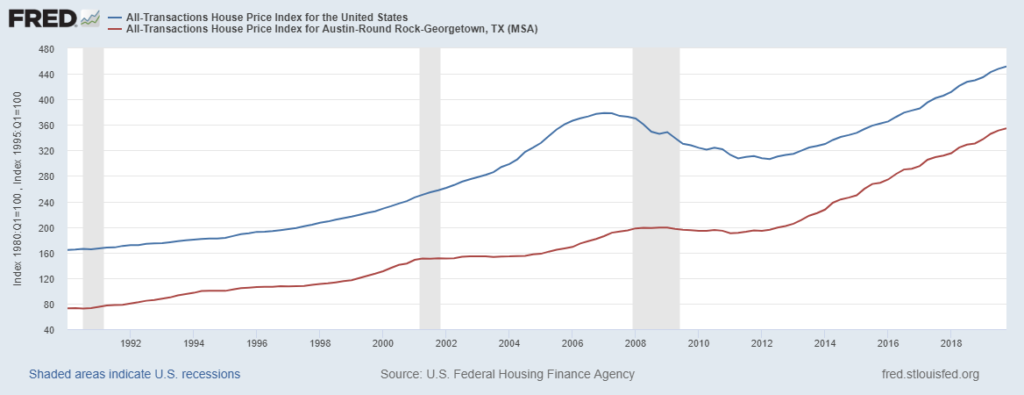

It’s hard to compare apples to apples, but take a look roughly at how the Austin area compares to the national picture in the chart from Economic Research at the St. Louis Fed (FRED).

The blue line in the chart above represents the US picture, the red represents the Austin area. The 2008 recession was more severe for the nation than it was for Austin in terms of prices, and perhaps the opposite is true for the 2001 one.

Do Austin Houses Still Sell During a Recession?

Median house prices and sales price data are not the full picture though. Having worked through the 2008 crisis, sales were just very slow. Part of that was a funding issue – the mortgage meltdown itself. Part of it in our opinion was that buyers seeing price drops around the nation expected similar discounting in Austin – which amounted to a very modest correction.

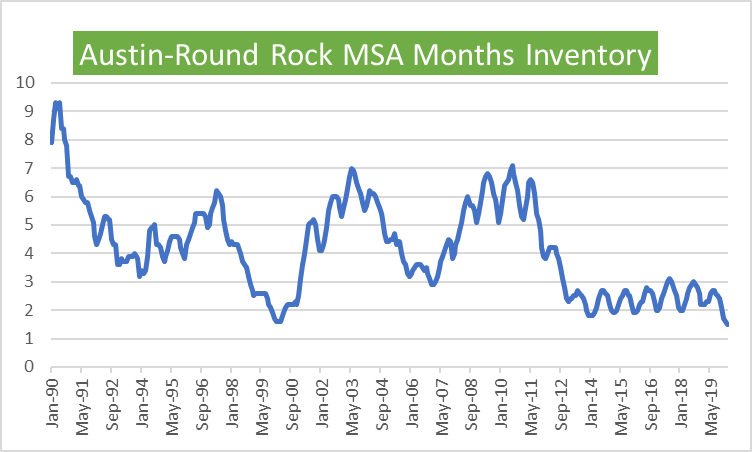

To see this in action, take a look at how much real estate was for sale.

You can see the big rise in inventory in 2001 and 2008 (but never as big as the previous recession in July 1990).

With seven or more months of inventory during these recessions, things were more favourable for buyers than sellers. This is in stark contrast to the sellers’ market we’ve had for the last eight years.

Where In The Austin Area Will House Prices be Most Impacted?

There are two big caveats with all of this. The first is the small print disclaimer that says past performance isn’t always the same as future performance.

The second is that these are all just averages, and spread across the region. In the 2008 recession, prices and inventory were affected in the far suburbs – new builds ground to a halt in the commuter areas. The Austin area has changed enormously since then, as has the employer base which drives the local economy.

In the last recession, the more stable and higher prices in Central Austin tended to carry some of the falling prices in remote suburbs to keep the average strong.

One of our favorite neighborhoods has always been Mueller, Austin. Residential construction had just started in 2007, and we saw prices falter for a while, but soon pick up.

In Summary

In summary – what happened to Austin house prices during previous recessions? Not much. But sales slowed and the market was more favourable for buyers with rising inventory. Less homes were sold in the time of uncertainty that followed.

We anticipate that this will be the same for some period of time in this recession.

In our experience there are many naysayers, but don’t underestimate Austin.

If you’re waiting for prices to come down before you buy or trade up, that is probably a bad bet.

Give us a call on 512 215 4785 if you’d like to discuss what this means for you as a buyer or seller in the Austin area in a Covid-19 landscape.

0 Comments