Here’s my favorite Austin loan officer John Schutze‘s weekend mortgage rate update:

Mortgage rates end the week 0.125% lower!!

European debt problems remained the primary focus this week, European officials are scheduled to meet this weekend and again next week, and they hope to release a plan for a comprehensive aid package by Wednesday. Officials are divided on what steps to take to help ease debt problems in troubled nations. With large countries such as Italy and Spain experiencing debt troubles, the potential cost of a bailout could be very high. It has been difficult to gain political support in the stronger countries, Germany and France, for aid to the weaker countries. For the countries that are at risk, it has been extremely difficult to implement the austerity measures required to receive aid, as the riots in Greece clearly demonstrate. Given the conflicting goals of the parties involved, the optimal solution is not clear. Whatever the outcome, it will likely have a significant impact on mortgage rates. A decisive plan to prevent the spread of debt problems could cause investors to reverse the flight to safety trade, leading to higher mortgage rates. On the other hand, a plan which disappoints investors could produce an increased flight to safer assets, causing mortgage rates to move lower.

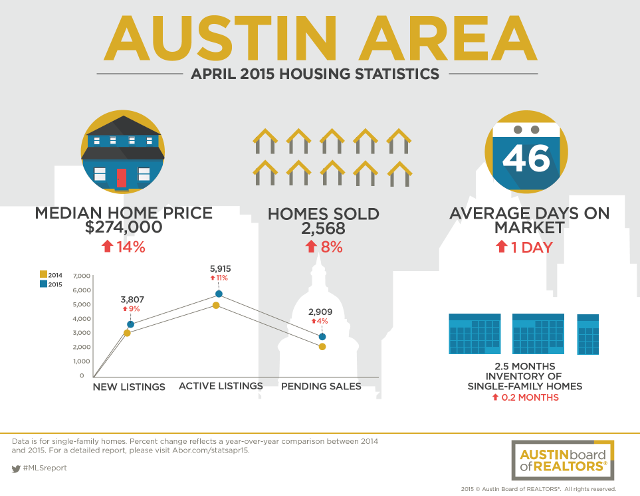

The housing data released this week was mostly better than expected. September Housing Starts increased 15% from August to an annual rate of 658K units, far above the consensus forecast of 595K, and the fastest pace in 17 months. Nearly all the gains came from multi-family units, though. September Existing Home Sales fell 3% from August, which was close to expectations. The inventory of unsold existing homes declined 2% to an 8.5-month supply.

Current rates:

30 Year Fixed 4.125%

15 Year Fixed 3.5%

5 Yr ARM 3.0%

FHA 30 Year 3.875%

VA 30 Year 4.0%

Jumbo 30 Year Fixed 4.75%

Jumbo 5 Yr ARM 3.25%

My take is that the Austin housing inventory is pretty low – mostly around 4.5 months of single family homes in the markets I look at. Get in touch if you want to learn more about the housing market in your area.

0 Comments