The Market According to ABoR

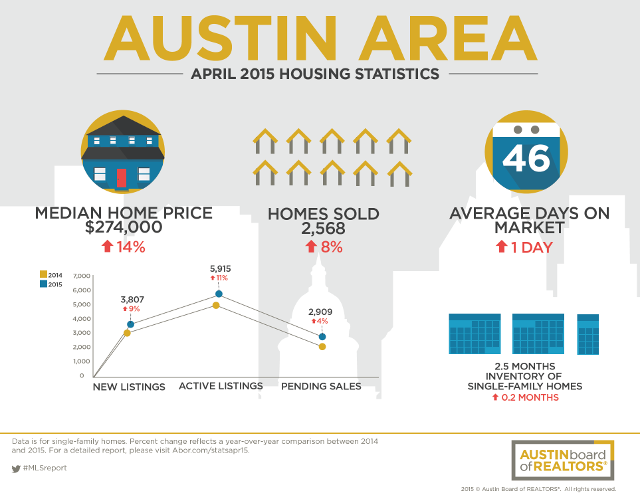

The Austin Board of Realtors have released their Multiple Listing Service statistics for single family home sales in April – could this be the beginning of the big slowdown in the superheated market?

If you look past the “more houses, higher price” headlines, you can see that the number of active listings (homes for sale) is growing faster than the number of pending listings (homes with an accepted contract). This is resulting in an increase, admittedly only a small one, in the number of months of housing supply. Remember, about 6 or 6.5 months represents a balanced market and we’re still down at 2.5 months.

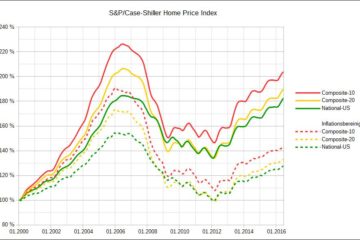

Initially my thought was that this was seasonality rearing it’s head – Spring always has the highest number of entrants to the market, but then I got the following chart in an email from the Austin’s Mortgage Authority – John Schutze.

Housing Supply

This chart shows the typical annual seasonality in Texas housing supply, the under supply in the first half of the 2000s and something a bit stranger more recently. For the last few years, there hasn’t really been such a pronounced selling season – inventory has remained consistently low.

The more observant of you will have picked up the changes in the data set between charts – at first we were talking about houses in Austin (quite a large area!) and then we moved to Texas for the second chart.

What do I think is really going on? The extreme sellers’ market can’t last forever in Austin – even as prices continue to rise they’ll hit a ceiling. That might be starting to happen in some markets – I’m seeing more sellers dropping their prices back into the realms of reality and possibility from some pretty outrageous list prices.

What does the Austin market mean for me:

buyers: expect multiple offer situations right now while mortgage rates are still low, and be ready to compete for homes. The early bird catches the worm.

homeowners: property taxes are going to rise by the maximum your taxing authority allows – hopefully you’ve got the 10% cap on annual increase to temporarily shelter you from a few years of >10% price growth. If you bought more than a few years ago, you might want to consider refinancing if your equity has gone up due to rising values.

landlords and tenants: rental rates are continuing to rise to offset property tax increases.

sellers: prices have to be realistic, and you might do better selling in a competitive market sooner rather than waiting for a higher prices but facing potentially rising inventory and competition.

If you’d like to learn more about the value of your home or how you are positioned in the market as a buyer or seller, please get in touch online or call 512 215 4785

0 Comments