As a home seller, there’s nothing more frustrating than having your home under contract and making plans to move only to have the contract fall apart at the last moment. Here are the top three causes and how you and your agent can avoid them. There are a few standard contingencies written into the One to Four Residential Resale contract that is used by Texas real estate agents by default. As always, everything is negotiable so if you don’t want your potential sale to implode and fizzle out into an untimely demise, pay attention to the detail.

Contract Death Sentence 1: Lookie Loo Option Money

The purchase contract is an option contract, so the buyer is paying a sum for the right to buy your home for a typically short period of time. In a heated market I’ve seen buyers put down a contract just to give themselves time to think about whether they really want it. Telltale signs are if one of the buyers is out of town and hasn’t viewed the property, and the option fee is low. Or sometimes the buyer will ask for a longer option period to allow for travel plans. Then the buyer’s agent will start to talk about how difficult it is to schedule an inspection these days and they need a bit more time to get their favorite third party home inspector.

How to avoid it:

As a listing agent, if the option money appears low or the option period appears high, then I would advocate that we negotiate on these items. If there are valid reasons for an extended option period, a seller can weigh up the cost of tying up their home in an uncertain state for that much longer. There’s nothing wrong with offering to extend the option period if the inspection ends up running slower.

Contract Death Sentence 2: Financing Failure

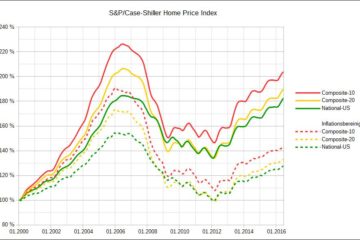

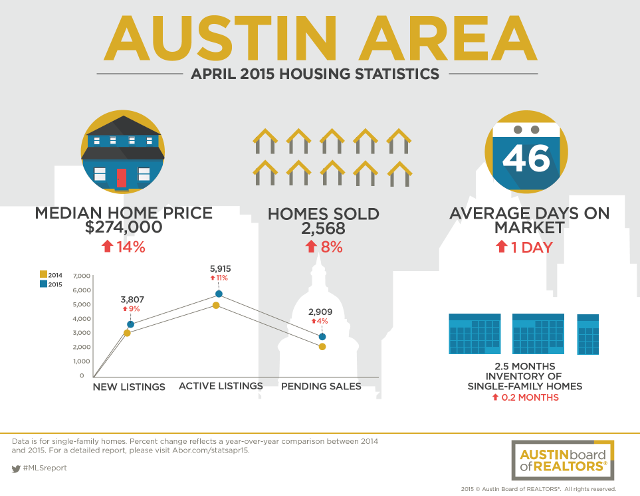

About four fifths of purchases involve some kind of financing, which means that a lender has to underwrite both the borrower and the home. If an independent appraiser comes up with a value for your home that is less than the contract price, then the buyer isn’t obliged to purchase the home, and you’re not obliged to sell it. More frustrating than a difference of opinion on value is when the borrower can’t qualify for the loan.

“Surely we’d know that before we went under contract – doesn’t the buyer have to be pre-qualified?”, I hear you cry. Well yes and no. Some agents think that the requirements to get a pre-approval letter from a lender are pretty minimal – a conversation about earnings and a quick look at a credit score. I think that they’re right.

As for getting the home appraised to make sure the values match, sometimes you’ll hear, “Oh, there’s a shortage of appraisers right now, so the appraisal hasn’t been done yet.” when you’re a few weeks into the contract. This isn’t acceptable.

How to avoid it:

As a listing agent I always contact the lender who has written the pre-approval letter and find out how far along the application process the buyer is. In my view, a serious buyer will have started to apply for a loan and handed over supporting documentation before they write a contract, and I don’t just rely on a form letter printed from a call center. In a high touch process, it’s also good for an agent to establish a rapport with the lender as early as possible, and if you’re given the number of a call center who won’t discuss details with you, that can inform the decision to accept or reject a contract.

There are always going to be odd underwriting requirements which surface later in the process, so my goal as a listing agent is to make sure the time the buyer and lender have to work them out is as short as possible. So we make that a requirement on the buyer and their lender, and don’t just rely on the “time is of the essence” clause in the Third Party Financing Addendum For Credit Approval.

Sellers should start asking questions if this is bigger than 14

Since the appraisal is of importance, we can add language to the contract which demands it is carried out within a certain time frame, and we can even add language which solidifies what will happen if the appraisal comes out below the contract price. Getting things written into contracts to provide for more predictability further down the line is essential to increase the chances of closing on time and closing at all.

Contract Death Sentence 3: Novice Agents

It’s true that every home sale is different, and every one we participate in has some new wrinkle that tests us as agents. Every transaction where we help a buyer or seller we learn something, and we avoid some of the pitfalls that a novice agent might have fallen foul of. Novice agents don’t know what they don’t know, and it’s easy to miss a date or a clause in the contract which inadvertently releases the buyer from their obligation to buy. Some of them are working part time as agents, and can’t return calls while they’re at their day job (yes, this really happens). Of course, as a seller you might not see inside the details and understand – you really need to be able to trust your agent to take care of these things for you.

How to avoid it:

The first thing I do as a listing agent when I get a contract from a buyer whose agent I haven’t worked with before is to check on the agent. It only takes me a few minutes to go along to the Texas Real Estate Commission website and check their history and to ask a few colleagues if they have any experience with the agent.

The other thing I do is hand over our contracts to two parties – one will check compliance of things written in the contract, and the other will track the dates in the contract and make sure dates are met. It costs us a little bit more but it ensures our sellers aren’t left inadvertently not selling.

Conclusion

By getting the right parties involved, working with experienced agents and by making sure that all the contractual get-out clauses are explicit and the contingency time periods are set to a reasonable minimum, you can make the home sale process in Texas more predictable and less likely to explode before closing.

Sherlock Homes Austin works with experienced agents to make sure you don’t have any surprises along the way when you buy and sell homes – give us a call on 512 215 4785.

0 Comments